End of Year Financial Planning Checklist

6 time sensitive financial moves you should consider now, in order to successfully close out 2018.

With the holidays upon us, it can be difficult to make time to get your finances in order. Many people push out closing their year until well into the next year (ever scramble in April to get all your tax work completed?). But there are several time sensitive financial moves you should consider now, in order to successfully close out 2018.

Review your open enrollment options and optimize your selections

Make sure that you and your spouse are coordinated on health care and dependent spending and 401k and Roth saving goals.

Adjust your tax withholdings

If you have had a child in 2017, been through a divorce, changed jobs or had a change in income, you will likely need to adjust your withholdings.

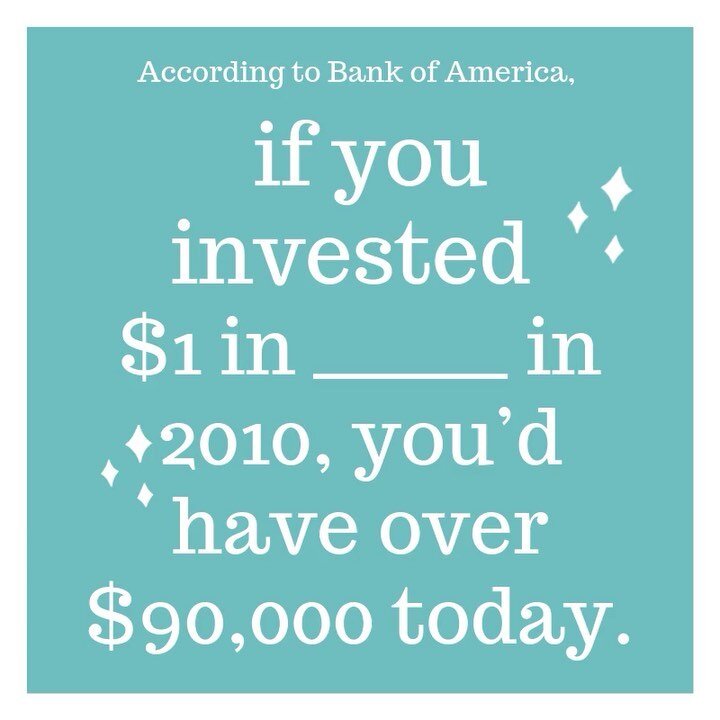

Fund long term savings vehicles (401k, Roth IRA, IRA, SEP IRA, 529s).

Contribution limits for your 401k is $18,000 and IRA is $5,500. Beware that there are limits on IRAs depending on your income. If you are self employed, take the time to fund a SEP IRA, which has much higher limits than a standard IRA or 401k.

Check your health and dependent care flexible spending plans

Track down your receipts and enter them now. I like to use this wind fall to fund Christmas. If you have not used all of your money, its time to do it now. Also, if you have hit your health care deductible, it may make sense to hit the doctor one more time to take care of anything you have been putting off.

Set an end of year budget.

There is a lot going on: gifts, travel, family events, parties, family pictures. Start to think, at the very least, about some guard rails that you want to set.

Start Planning for Next Year

Set up a meeting with your financial planner. Now is the time to start setting some longer term goals for next year and help secure your retirement for tomorrow. Let me guide you through the process and monitor your progress.

FOLLOW US ON INSTAGRAM: CHAMBERLAINFINANCIAL

How to Set Financial Goals as a Couple

It is important to set goals that you can work on as a couple. Being on the same page with your joint finances helps to strengthen your money situation and your relationship. As a follow up to How to Talk about Money with Your Spouse, we are taking things to the next level: 9 Steps to Setting your family financial goals.

9 Steps to Setting Family Financial Goals together As a Couple

It is important to set goals that you can work on as a couple. Being on the same page with your joint finances helps to strengthen your money situation and your relationship. As a follow up to How to Talk about Money with Your Spouse, we are taking things to the next level: Setting your family financial goals.

“Our goals can only be reached through a vehicle of a plan, in which we must fervently believe, and upon which we must vigorously act. There is no other route to success.” -Pablo Picasso

Organize your goals by Time frame

I like to break goals into short, mid and long range time frames:

Short term goals: < 1 year

Mid term goals: 1 - 5 years

Long term goals: 10 - 20 years

2. What are Short term goals?

What is going on in your life, that needs to be immediately addressed? Maybe you have been putting off a house project, but you don’t know how to get started. Maybe you want to plan a family vacation, for some good quality time or you need to you have money sitting in an 401k from your last job and you need to roll it over but your not quite sure what to do with it.

Short term goals are generally fairly easy to envision. You know your current self, so you know what you need to do. However, writing down your short term goals and talking about them, will help in actually getting them done.

3. Mid term goals

Mid term goals tend to be a bit tougher than short term goals, because you know what they are, but you know it is going to take more time and effort to get there. You will need to monitor your progress and you will need a plan. Mid term goals are things like: Planning to start a family, paying down debt, saving up for a down payment on a house or switching careers in the next few years.

4. Long term goals

“A goal is a dream with a deadline.”

-Napoleon Hill

While mid term goals are difficult because they require work, long term goals are more challenging because they seem ephemeral, variables can change as time passes and they are difficult to envision. You may not know what really matters to you, yet. You may foresee changes in the future that could impact your goals. Or maybe you just can’t imagine yourself in 10 years. Long term goals require some real thinking, discussion and envisioning. You may need to dig in and dream a little!!

5. Brainstorm, then compare notes

Now we have defined what we mean by the different time frames for goals. How do you actually have a discussion around your shared financial goals? First, realize that this discussion may prove to be harder than you thought. For example, you may find that your goals are not aligned (at all).

I am a fan of the sticky note method: Using sticky notes, spend 5 minutes separately jotting down as many short term goals as possible. Write it all down, even the absurd … brainstorming is not a time to “cull the herd”, dream a little and have fun!! Then come together and share your sets. As a team, now is the time to really start to evaluate what makes sense. It is also a time to stop and appreciate the unique perspective of your sweetheart. DON’T go about bludgeoning, like baby seals, your sweetheart’s ideas. Be open minded. Then iterate through mid and long term goals.

6. Don’t jump into solutioNing!!

The point of the discussion is to create a set of goals. A plan to accomplish those goals, should come after the set is created. Too often, a goal may be jettisoned early in the process because it may seem hard, or because there is no clear path to achieving it. Don’t let that hinder you. Goals are meant to be hard. They will force you to plan and work.

7. Prioritize

“Most people overestimate what they can accomplish in a year, and underestimate what they can do in 10!”

-Bill Gates

It’s time to determine if the entire set is reasonable. If you believe you can reliably reach all of your goals, it’s possible you were not audacious enough. I say live a little, be bold!! If on the other hand, you have gone completely nuts, now is the time to start getting realistic. Start by deciding how much you have to fund your goals. Then break up the funding as a percentage of short/mid/long term goals. A good recommendation is: 25% - short, 35% - mid, 40% long term. Now is the time to edit, get rid of things that you can’t fund. Or deprioritize them to a future discussion. My mantra in these discussion is: if I can’t prioritize them now, maybe they are not really worth prioritizing at all. This is where the planning really comes into play.

8. Share your goals with friends and family

Now that you have your set of goals, unpack them in front of friends, at dinner or over drinks. How do they feel having rolled them around in your mouth, are you still resolute in what you have? Did you get any good opinions? Additions? Good Ideas? Do you now have some accountability partners? Did you inspire your friends to have a similar discussion? Incorporate good ideas into your plan. But don’t necessarily allow someone to dissuade you from something important.

9. Rejoice!

You made it through the discussion. Having these crucial discussions with your sweetheart will fundamentally strengthen your relationship. Too many times, we hold back, in order to not offend or hurt our significant others. When you shared insights with your friends, did the two of you have to work together defending your aspirations? Having struggled through the discussion, will ultimately make your relationship stronger.

Please don’t worry if you hit some road blocks during the discussion, I am here to help. This is tough to navigate on your own. Sometimes the issue is in getting an achievable list. Sometimes the struggle is coming up with the plan to reach the goals. Let’s set up some time to talk!