What The Hell Is Financial Planning?

Financial planning isn’t a budget or getting life insurance or something you do once and can set it and forget it. Financial planning is an ongoing process to help you make sensible decisions about money that can help you achieve your goals in life. Here’s what it looks like…

I have recently been asked: “Josh, What exactly is this financial planning thing you keep talking about?” Is it something you do one time? Is it creating a budget? Is it just getting assets into a brokerage account and then figuring out how to invest those assets?

Financial planning isn’t a budget or getting life insurance or something you do once, set it and forget it. Financial planning is an ongoing process to help you make sensible decisions that can help you achieve your goals in life.

Financial planning: An ongoing process:

1. Developing a set of family goals and objectives

2. Creating a strategy for reaching those goals

3. Implementing the tactics that will enable the strategy

4. Monitoring the plan to ensure goals are being reached

5. Adjusting the plan as new variables become known

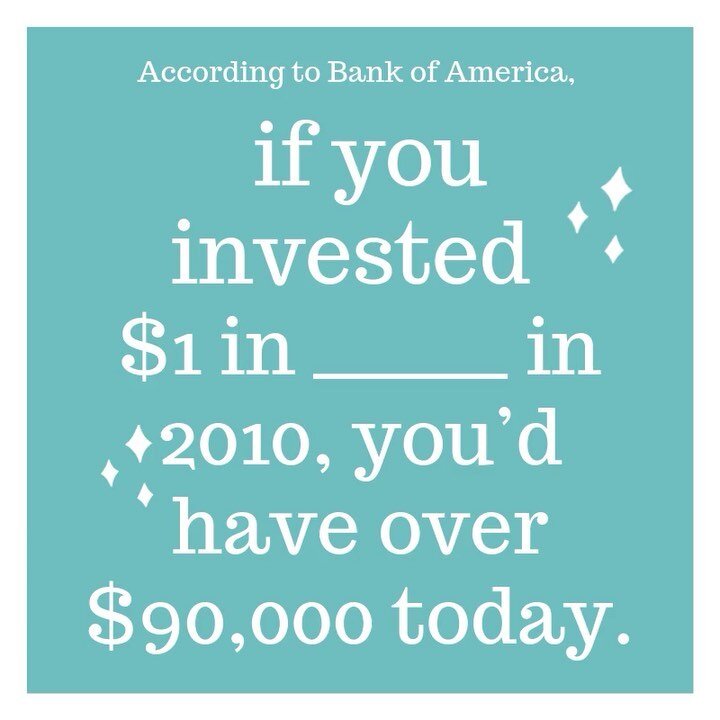

An Example (aka Free Financial Advice)

Here’s an example of how financial planning works. I’ll use a family goal that we can all relate to. Consider this free financial advice. The specifics below might be slightly different for your situation but you will be able to see yourself in this scenario. Feel free to bookmark this page ;)

Family Goal: Safeguarding you and your family from the unexpected

If things go sideways (e.g. the roof blows off the house, you unexpectedly need a new car or there is no salary for several months) you and your family can continue to maintain your current lifestyle without worrying about your day-to-day expenses.

2. Strategy to reach this goal:

Disability insurance

Monthly budget for “things that come up”

Rainy day fund

3. Implement the following Tactics:

Sign up for your company’s disability insurance covering x% of salary.

Factor in an additional $500 into the monthly budget for “things that come up”

Build a rainy day fund equivalent to 3 months of expenses

4. Monitoring:

Is the paycheck reflecting disability insurance getting paid?

Is the monthly budget getting funded an additional $500 each month?

How is the rainy day fund progressing towards 3 month’s of expenses?

5. Adjust:

Once the rainy day fund is fully funded, its time to start diverting money to another longer term goal.

ThIS planning thing seems like a major undertaking!

It is a serious undertaking. Understanding your goals, from securing your future, to living life to it’s fullest today and tomorrow, takes a lot of planning and commitment. My passion is helping families dream big, make a plan to get there and then monitor them and their assets to ensure they succeed. We each get one life to live and we need a plan to make sure we make the most of it: Work hard, have fun, and love our friends and family.

A Chamberlain Financial Advisors Financial plan will cover:

Understanding your long term goals.

Looking at insurance and risk mitigation.

Understanding streams of income.

Understanding streams of expenditures.

How to fund various investment vehicles that will be used to your fund goals.

Selecting low-cost ETFs that match your risk profile.

Retirement planning - how will you live when working less.

Estate planning - what will happen after you turn into a rainbow in the sky.