What Types of Property and Casualty Insurance Do You Need?

Planning for the unexpected is a key part of any financial plan. In this post we will discuss what types of property and casualty (P&C) insurance should be part of your financial plan.

In life, it’s inevitable that things sometimes takes an unexpected turn — or just plain go wrong. That’s why planning for the unexpected is a key part of any financial plan. In this post we will discuss Property and Casualty (P&C) insurance. P&C coverage basically covers your stuff, and any liability that might come from you and yours being legally responsible for someone else’s injuries or damages. The most common forms of this type of coverage for a family are: Homeowners, auto, personal articles and umbrella.

“When reading this, know that I am a fee-only financial advisor. I don’t get any commissions for recommending or connecting you with an insurance agent or policies. My goal is to provide the best advice possible, in order for your family to grow towards your goals.”

Property & Casualty insurance

any stuff you own except for your cars, motorcycles (vehicles) or boats

Homeowners Insurance

What do homeowners property and casualty provisions cover?

Here are some scenarios where homeowners insurance would come into play:

A visitor falls and breaks their leg at your home.

A worker gets hurt while working on your property and cannot perform their job due to the injury.

You are sued by a visitor after they were injured at your home.

You were robbed.

Your home was damaged due to weather —like a tree falling on your house.

The key components of a homeowners policy are:

Dwelling value - This is the amount that will be reimbursed should you have to repair or rebuild your home. This is a tricky number, and it is the basis for your yearly premiums. This is a classic Goldilocks problem, not too high, not too low … just right. I use several different methods to narrow the number. I start by checking out zillow to get a feel for the total value of the house (this sets a top limit) as well as the square footage of the house. Then I multiply the sqft by a local building multiplier. In Decatur, I see building costs between $175 and $200/sqft. So for a 2000 sqft house * $200 sqft = $400k for the dwelling value. Then I will subtract from the zillow total value, the cost of a tear down. In Decatur, typical tear downs (IE, land) costs around $400k. So if the total value of the house according to zillow is $800k, I subtract $400k and come up with a dwelling value of $400k.

Other structures - are buildings on your property, not connected to the main building, Eg, a detached garage. Other structures are typically covered as a percentage of the dwelling value coverage, like 10% of dwelling.

Personal property - this is all of the stuff inside your home. If you lose your home to a fire, after you rebuild, you will need to replace all of the furniture that was lost. This provision will take care of that as a percentage of the dwelling value. Typically this will be in the neighborhood of 75% of dwelling. It as also smart to walk around with your phone and take a video of the contents of your house, and store the video in the cloud.

Liability - this is the amount that would be covered if you were found liable for someone being hurt. The more, the better. This is typically between $300 and $500k.

When buying insurance, you need to decide on a deductible, the amount that you will need to pay should you file a claim. The deductible is meant to keep you from constantly making claims. So the deductible needs to be an amount that you can come up with in an emergency. The deduct typically falls around $1000-2500. The higher the deductible, the lower the premium. A good deal I helped a client secure was a homeowners quote on a $500k dwelling cost for around $1500/year.

Auto Insurance

The key components of an auto policy are:

Bodily injury liability - This is described by an amount per person / per accident. Eg, 250k/500k means that each person will get a max of $250,000 of liability with a total coverage of $500,000 in an accident. For example, if you are in a car accident and are at fault (liable), and you have a $250k/$500k limit, then each person in the car you hit can get paid a maximum of $250k. Your insurance will pay a maximum of $500k to the people in the other car. If the amount is greater than $500k — then you would need umbrella insurance (which I highly recommend and I find is often neglected) see below.

Property damage - The amount that is covered to replace your car.

Uninsured motorist -This will cover you (the insured) should you have an accident with someone who has no insurance, or is underinsured.

“For auto insurance, pay attention to the deductible. You are much more likely to file an auto claim than a homeowners claim. Which means you likely need a smaller deductible.”

Auto insurance is highly variable and will depend on the type of car, the age of the car (and the drivers) and your driving record. A good deal I helped a client secure was 250k/500k/100k coverage on two (15k valued) cars, with good driving record for $2k/year.

Personal Articles

Personal articles coverage is typically for expensive, hard to value items that are dear to you. You would normally see this on your wife’s engagement and wedding rings and guns/stamps/coin collections. The coverage is not super expensive, typically costing around $100 for every 8-10k of valuables.

Umbrella Insurance

is for providing extra liability coverage, should something happen that causes you to exceed the limits on your other coverage.

Umbrella Insurance

Umbrella insurance is for providing extra liability coverage, should something happen that causes you to exceed the limits on your other coverage. Typically umbrella comes into play when you get into a car accident. Eg, you have 250/500/100 coverage. You cause a car accident that involves a family of 5, who all end up with extended hospital stays. They will rapidly use the 500k limit that is available to you. An umbrella policy will cover the difference. Generally I see these around $1MM, and cost around $200/year. I highly recommend having umbrella insurance. It’s inexpensive and if you don’t have it and wind up hitting a minivan family of 4 with a $1MM liability, you could lose everything. For ~$200 that’s an easy price for security and peace of mind.

Insurance Guiding Principles

Insure against low probability, high cost issues.

Think about your coverage limits,. This is a classic goldilocks scenario, you want the number to be just right, not too high, not too low.

Shop your rates every 2 to 3 years. Insurers change their rates based on their market.

Know that if you make a claim, your insurance company is going to raise your rates or maybe even drop you.

Bundling your insurance with one company can offer you nice discounts.

If you have insurance through a company that you have seen on ads during the Super Bowl, you may not be getting the best rate.

If you fell asleep several paragraphs ago, or have not shopped your rates in the last few years, contact me. I am most assuredly NOT an insurance agent, but I can give you some recommendations. I have also been having really good luck with a local independent agent, who has been finding clients less expensive rates while getting higher limits! Send me your policies, I am glad to shop them.

**Thanks to everyone who gave me feedback on topics. Insurance was the top choice.

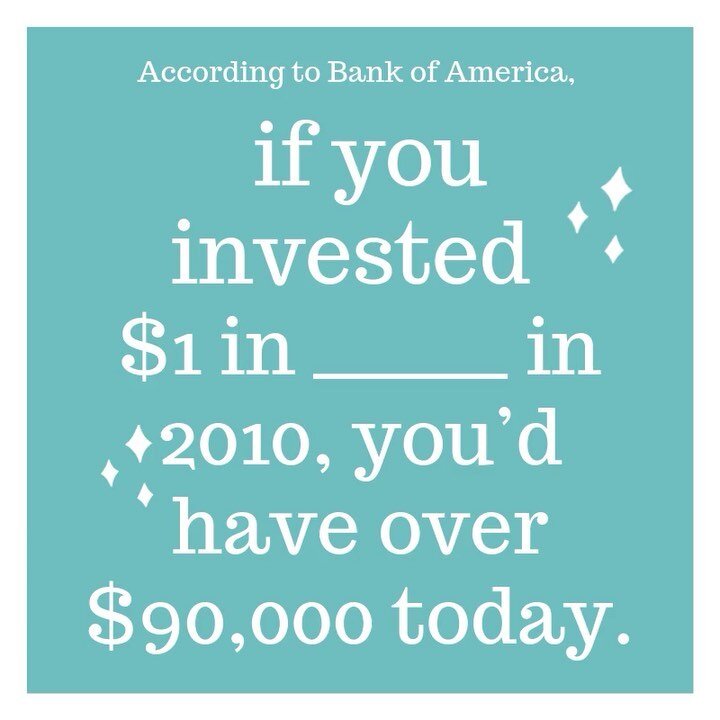

2 New Apple Products That Could Save You Money

Apple held its annual spring event at its headquarters in Cupertino, California, on Monday, March 25th. Two of their new products are particularly interesting from a personal finance perspective and could save you some money.

Apple held its annual spring event at its headquarters in Cupertino, California, on Monday, March 25th. Two of their new products are particularly interesting from a personal finance perspective and could save you some money.

Apple News+

I am an apple snob and stockholder.

We have too many apple devices in our household.

Apple News+ is a new service that allows you access to a large number of magazines and newspapers, as well as their standard news content. This comes at a set monthly subscription rate of $10/month. At first blush this seemed like an interesting deal for $120/year. I’m skeptical of monthly subscriptions but I love magazines, and I get my news mostly from The Wall Street Journal and The New York Times. So I figured I would run a quick audit in our house to see how much we spend on annual new/magazine subscriptions. I used magazines.com to determine pricing.

GQ - $20/year

Bon Appetite - $20/year

Fortune - $20/year

The Economist - $95/year

ESPN the Mag - $30/year

WSJ - $467/year

A total of $652 in reading material!

Holy crap … I was slightly horrified to realize that total. The vast majority of my reading is on a screen, so News+ seems like a bit of a no brainer for our family. Do you know how much you are spending on this category? Add it up!

Apple Card

I am generally opposed to credit cards as a means to pay for your typical monthly expenses. I prefer to spend out of my checking account, so that I know exactly what I have available. And it forces me not to over spend. When I really want to nail down my monthly discretionary spending, I like to load my weekly cash on the Cash app card. I also think that cash back rewards and sky miles bonus points are gimmicks meant to entice your lizard brain to spend more.

If you decide that you need a credit card, if you travel at all, you will, or that you can control your spending urges, and want to get the cash back rewards. Apples Card is a pretty cool product.

It is tightly tied to your apple wallet

it gives daily 2% cash back rewards

it allows you to control your payment options

it provides some visibility into you budgeting/category spending

it gives you a physical version, made of titanium

there are no annual charges

So all in all the new card (which is not yet available), looks like an interesting product. I am curious to see how things play out when it is available. I like the easy integration with the wallet. And I like visibility it provides for your spending.

*Note that there are currently cards available that offer a nice cash back option. So you don’t have to wait for this card to get cash back.

Josh’s Retrospective On Buying a Used Car

The goal was to find the right car for my family, while taking the emotion out of the process. See how I narrowed down the search, prepared for the negotiation and dealt with the curveballs throughout the car buying process.

Part 2 of Josh’s Car Buying Process

I’m happy to report we bought a great car, that met all of our needs AND was within our budget— A 2018 Toyota Highlander Hybrid.

The goal of my car buying process, was to find the right car for my family, while taking emotions out of the process. The last thing I wanted to have happen, was to show up on a car lot, and become convinced that we “needed” something that we did not.

After the test drives, and pricing research, we decided on a Highlander Hybrid. I had done a good bit of research on Autotrader and ebay motors. I knew that the 2016 and 2017, were our best bets for our sub $40k car budget. However, when we got serious, we found that there were not many hybrids available. So I opened the search to include 2018’s. I was surprised to find a 2018 at a local VW dealership listed for $36,500 … $2k cheaper than any of the 2016/2017’s that I had been monitoring.

Hmmm…The color was not our first option, but I figured it was worth going to check out, and report back to Jenn, with some pictures. This was going to be Jenn’s daily driver, so she had the final decision making power.

I scheduled an appointment for the following day with Tom.

I steeled myself against several variables:

The dealership may try to bait and switch me.

The car could have some undisclosed problem.

The color could be vile.

I came prepared against the used car salesman onslaught with the following:

This was a VW dealership and they may not know what to do with either a Toyota or a hybrid

It was the end of the month and a nasty rainy day.

I had the car’s listed price in writing.

I checked the Carfax and there were no incidents reported.

I was comfortable with my view and options of the market for this car.

The picture I sent Jenn for color approval.

At the Dealership

I met up with Tom, who did not immediately irritate me. I got a great cup of Starbucks coffee, and we took the car for a drive. It drove great! I could see this car joining the family. The outside color, live and in person was good, it had all the options, and the inside leather was exactly what we wanted. I sent several pics of me in front of the car, to Jenn, so she would have a good idea of the color… and she liked it. When I started to explore all of the nooks and crannies of the car, I was pleasantly surprised to find all of the cars records! The previous owner had the car serviced at a dealership at the exact mileage specs. There were no problems reported during her ownership. And given that it had 30k miles in one year of service, I knew the car had mostly highway miles and not stop/start puttering around town. The car had a big sticker on the windshield with a price of $41K … the “proper” price for the car. So they had clearly dropped the price to move it off the lot. I was pretty stoked, but I did my best to practice my ujjayi breathing.

After talking to the manager he came back to me with “unfortunate news”.

I told Tom I was ready to sit down and talk turkey. I told him I really liked the car, it was in a great condition and that I only was authorized to spend $35K, could he work with me? After talking to the manager he came back to me with “unfortunate news”.

I KNEW IT. I STEADIED MYSELF!

He was really sorry, but his manager had apparently sold the car that morning to a sister dealership, and they had a flatbed en route to pick up the car. Sorry, if he had known that, he would have called me to wave me off.

“Uh, WTF?” I thought. I just sat there and looked at Tom, wanting to throw my cup of coffee across his desk.

“Uh, WTF?” I thought. I just sat there and looked at Tom, wanting to throw my cup of coffee across his desk. He finally offered, that it would be in both the dealerships best interest (higher used car sales for the month), as well as his own (commission), to sell me the car. There would be NO negotiation and they would have to eat crow with the sister dealership. I had 15 minutes before the flatbed arrived.

My initial reaction was “I am out of here!! I am not a person to be trifled with, by these games.”

I had set myself up to remove the emotion from the equation, but I was letting my ego get the better of me.

And then, I paused and asked for a few minutes to go sit by myself and evaluate the situation and restarted my ujjayi breathing. I had set myself up to remove the emotion from the equation, but I was letting my ego get the better of me:

This car was the right make/model/ and even better year than I expected.

It was in great condition.

It was $2k cheaper than what we expected to pay.

We bought it

I called Jenn and we decided to pull the trigger. On top of that, we got a super low interest rate loan through a credit union. And 2 weeks in, Jenn says it is by far, the best car she has ever driven.

At this point in time, I am pleased with the process and the outcome. We followed the process, we were thrown a few curve balls, we dealt with them, we got a great car and everybody is happy.

Do you have someone who puts this much thought into the car buying process? Should you? Let’s talk if you are in the process of buying a car.

Budgeting Part 3 of 3: The Squeeze

Learn the most efficient way to monitor, analyze and squeeze your spending so you can grow your wealth.

BUDGETING 101: for people who hate budgeting PART 3/3:

In Budgeting Part 1: Do you need a budget, you decided you were jumping on the bandwagon, getting your act together, and starting to budget like an adult. Then in Budgeting Part 2: How to start a budget, you learned, by limiting the amount of money in your spending account, and prioritizing your goals. But now, you can’t seem to make ends meet, and you just are not sure where all of that discretionary money goes.

Your Next Steps

Recognize why you are budgeting.

Your goals are important and you need to be intentional if you want to achieve them.

This budgeting system works If you put in the work and sacrifice.

There’s no way around it: progress requires efforts outside our comfort zones. But you can do it. The key to being successful with budgeting is being clear on your priorities and making progress towards your short-term goals to keep you motivated. Without a budget, we spend money without intention. Twenty dollars here, eating out often, buying whatever strikes our fancy… robs you of your goals.

Budgeting Tools

You need some visibility into your spending, so that you can understand where you cash is going. The best way to do this is with technology. There are lots of tools available. Don’t get too caught up on the decision, there are pros and cons to them all. Check them out quickly, and pick one. The only way to determine if you will really like it is to try it for a month or two.

What do I use? Tiller.

Tiller offers a free 30 day trial and then it is $59/year.

Setting yourself up for success

After selecting your tool, be prepared to spend some time getting things set up. This is where the work comes in. If things go well, it will take an hour, but it could take as long as 3 to get things “just so”. You will need to link up your spending accounts. And then set up categories, to assign to expenditures, that suit you. Typically there will be a set of standard categories, but if they do not all speak to you, create your own. And delete those that you will not need. After you have the accounts linked, and the categories make sense, go take a break. Great job! You are super close.

Then spend 2-4 hours, and categorize the last month or 2 worth of expenses. Get everything categorized. You will need to be thoughtful of the categories otherwise, you’ll have a Goldilocks problem: If you have too many categories, it will be hard to see major trends in the data. And if you have too few categories, it will be hard to see trends in the data.

analyze your spending trends

Once you are satisfied with the data and categories, it is time to start analyzing the data. Are there obvious areas that you are spending too much on? Typically a nice starting point is on:

Eating out

Groceries

Entertainment

Credit cards

Toys

Technology

slowly squeeze your spending

Once you see a category that seems out of whack, or takes too high a % of the your overall discretionary spending, give yourself a goal. Start by limiting that category to 90% of last months bill.

Eg: you spent $1000 last month on eating out. That constitutes 20% of your discretionary budget and is also equal to the amount you spend on groceries! Start your next month will a goal of $900 ( $225/week).

Repeat that process for each major category that “needs some attention”. Also, shoot for a total goal for how much you need to trim? Perhaps your overall goal is to trim $500. Take off $100 from 5 categories, and you are there.

monitor your progress

The last step is monitoring. Block out a dedicated time each week 15 - 30 minutes, where you spend the time categorizing everything. If you set up the time to create the best categories for your spending, then this will be automated and just require a few adjustments. Each month it would get easier and take less time.

Then acknowledge where you are for the month. If you are over: tighten your belt for the following weeks. If you are on track … Great job.

If you survived the first month, but have not yet reached your savings goal, DON’T FRET!!! You are doing great. Just trim more in categories that are out of whack.

Continue to squeeze until your goals are allocated, and your spending is “under control”. With a little work, some dedication and grit, you will get there. You should start to see good results by month 3 or 4.

Q. IS THERE A PARTICULAR TIME BEST SUITED FOR THE WEEKLY WORK?

A. I suggest some time in the morning, when you are fresh. A perfect time is over coffee on Sunday morning. You also want to allocate your weekly discretionary money on Monday, not Friday.

Q. I AM HAVING TROUBLE SITTING DOWN AND DOING THE WEEKLY WORK. SUGGESTIONS?

A. An accountability partner is always a good idea. Let a friend, mentor, family member know that you are working on this. And you need to have your partner involved in the results. It takes both partners to succeed at this.

Q. By SATURDAY, I’m LOW ON DISCRETIONARY MONEY, And … MY FRIENDS ARE GOING OUT, I DON’T FEEL LIKE MAKING DINNER and I want to go shopping!

A. Yup, budgeting is about prioritizing, which means you will have to sacrifice some. Stop trying to keep up with the Jones’!!

Q. I HAVE BUDGETED DOWN TO THE NUB, AND NOW I HATE MY LIFE BECAUSE I CAN’T HAVE ANY FUN.

A. This is not what you want to happen, because it ultimately leads to you falling off the wagon. You have several options:

1. Get rid of some of your expensive bills, like a brand new German car. Maybe cutting the cord on your cable bill, will help.

2. Cut out some of your monthly subscription services for entertainment (apple music, Netflix, Spotify, Audible, the gym you never use, etc).

3. Is your home too expensive?

4. Were you too fast or ambitious with your expense squeeze?

Need to review? or IN case you missed Them, parts 1 and 2:

Budgeting Part 2 of 3: How To Start Budgeting

The sooner you can get started, and make progress, the more likely you are to stick to it and succeed. So, let’s do this!

BUDGETING 101: for people who hate budgeting PART 2/3:

How to get started

Congratulations! You’ve realized you need a budget. That is the first step towards being in control of your finances, and half of the battle! The next step is getting started with a budget. The sooner you can get started, and make progress, the more likely you are to stick to it and succeed. So, let’s do this!

The majority of the advice out there approaches budgeting with expenses and tools. I have a different approach: First, take a breath. Innnnnn and ouuuut. Then, we begin with your income.

The easiest way to stay in control of your budget is to never have money show up in your “spending” account. Having a big chunk of money in your account is too tempting. Right after you get paid, it’s natural to think, “I work I hard, I deserve _________.”

fund your goals

with automatic payroll deductions

401k - start with 5% of income or max out a company match. For every $100k, that is $208/paycheck. You wont miss it, but over a career, your future self will be pleased.

Health Savings Account - look at last year’s out of pocket spending, set it there.

Dependent care savings plan - what is your kids’ day/after care expenses? You are already spending it!!

set it and forget it

Don’t be average:

The average American has 3.1 credit cards with an overall outstanding balance of $6,354.

Credit Card Usage and Statistics 2019

set yourself up for success with online bill pay

Ok, so you funded some of your goals, but now your paycheck is in your account, and you are feeling flush! Set yourself up for budgeting success by going to your online bill pay and setting up automatic payments immediately after every paycheck .

Schedule automatic monthly payments for:

If you are self employed

Set up a SEP IRA and have money automatically contributed to your SEP IRA account.

Your non-discretionary bills immediately and make it a set amount each month.

We pay GA Power $200 every month. During the winter we build up a nice cash reserve, during the summer we spend it down. The opposite happens with the gas bill. I also like to round up to the nearest hundred on my mortgage, with the extra going to principal.Pay off your damned credit cards! Start with the one with the smallest payoff and allocate all but the minimum amounts for the others.

Transfer money into a savings account for a rainy day fund.

Fund your short term goals: Transfer money into a vacation savings — or other short-term goal like a new car or house renovation project.

IRA or a brokerage account and the kids 529’s - if you are doing nothing, make it $100. Increment in. As you get comfortable, increase it.

“The goal here is to fund your goals, and never even think about the money “leaving” your account, because it never really “enters” your account.”

Don’t EVER give your bank account info to a company to take out auto payments.

You need to control the movement of your money.

Discretionary Spending

Take a moment to recognize the work you’ve done: You set up automatic payments for your non-discretionary bills AND your goals are being taken care of. That is a huge step. Nice work! What will remain in your account, is THE ONLY CASH you have left to spend on discretionary items. That means, you make a promise to yourself: NO CREDIT CARDS when you run out of money at the end of the month.

Advice on credit cards

Credit cards are bad. This is worth repeating: NO CREDIT CARDS. That means, you make a promise to yourself:

DEAR SELF:

NO, I MEAN NONE , NOTHING, NADA GOES ONTO A CREDIT CARD, not even to earn miles for the trip I’m not going to take in the indeterminent future. And if I do take the trip, it will likely be during a blackout dates and I won’t be able to use those elusive “rewards” anyway.

Yours Truly, (really I’m yours… am I getting too meta?)

Me.

Budgeting FAQs

q. I get paid twice a month, I can’t afford to pay all of my bills at once! How will i be able to afford to eat or live reasonably until my second pay check?

or

q. My bills are spread throughout the entire month how do I manage not getting late fees?

A. Both of these questions have the same answer: Spread your non-discretionary bills across your two paychecks. What that may mean is, the majority of your bill paying in your first pay check, goes to the mortgage (and maybe a few utility bills). Leave yourself enough left over, so that you can buy gas and groceries until the next paycheck. On your next paycheck, finish off the utilities and your savings for goals. Leave just enough for your discretionary spending, to make it to your next paycheck.

q. what if one of my big utility bills (e.g. my car loan), needs to wait until the second paycheck, but is due on the 8th of the month, and will thus be late?

A. Most of the time, if you are up to date on your bills, a company can work with you to change the due date, give them a call. If they won’t, make a minimum payment on your first paycheck, and then finish the payment on the second paycheck.

q. Why autopay the same amount each month?

You want to set up your payments on autopay, and don’t want to wait on the bill.

You don’t want to worry about any accidental underpayments.

Over the course of the year, the payments will average out.

Q. Josh, by the end of the month, I either don’t have any money left over, or worse, I am spending on my credit card to make ends meet!! This method sucks, what gives?!

A. Good question… the answer to this is in Budgeting Part 3

Not sure if a budget is for you? Take my free assessment:

Do You Need A Budget? Take Josh's 13 Question Assessment To Find Out

Check out Josh’s checklist to see if you should be using a budget

BUDGETING 101: for people who hate budgeting PART 1/ 3

When working with my clients, the first thing I have them do is forget about money and DREAM BIG! I know it sounds weird but stay with me for a moment. Next, we take those dreams and organize them into short/mid/long term goals. Then money and finances comes in. My approach to personal finance is that your money should fund your dreams and goals. And the way we do that is through… BUDGETING.

Do you really need to budget?

Yes.

Don’t believe me? If you answer yes to any/all/many of these, keep reading.

Is your income bucket dry at the end of the month?

Do you use credit cards to fund your lifestyle?

Are you lacking in long term savings for retirement?

Would you like to go on more vacations?

Do you ever fight or stress about money?

At the end of the month do you wonder where all your money went?

Will your kids need to take out loans to go to college?

If you needed a new roof on your rental place (I do!), you would need to pay for it with credit cards or loans

Does your retirement plan include working forever?

If you answer False to any of these, you need a budget.

You have 3-6 months of your typical household spending saved and earmarked for emergency funds.

You know your monthly household expenditures.

You mapped out your short, mid and long term goals and are actively working towards reaching those goals.

You know how much you need to retire and have a target date when you will likely reach that number.

Why are you NOT budgeting now?

Now that you understand, you should be budgeting, let’s address why you aren’t already doing it.

You make too much money, and have plenty at the end of the month

It sucks the life out of you

You tried it and quit

It takes too much time and its boring

The tools for budgeting stink

It causes fights at home

It’s too much work and nobody wants to take the responsibility for driving the conversation

You are slowly but surely reaching our goals without one

You’ve tried it before and failed. You just can’t stand to have to fail at it again

That’s just a few reasons (or excuses) I’ve heard over the years. I get it. Budgets aren’t exciting. But it’s a key component to reaching your goals. And goals are exciting. For example budgeting could fund a fabulous vacation all paid for upfront.

From my experience, 99.9% of people would benefit from a budget. Even those of you with plenty of cash at the end of the month!! Hello, retiring*** at 54 instead of 56! Hello buying the turbo instead of just the V6!! Hello, philanthropy.

The Importance of a Budget

watch this short 50 sec Video to see why you need a budget.

Thanks to my wife for sketching out this visual.

Income filling a bucket at the top of the process.

Out of the income bucket are a set of spigots, that are used to fill expense buckets, first and then goal buckets next.

The key is to control your expense spigots so you can fund your goals.

Non-Discretionary Expenses

The biggest monthly expense for most is housing: a mortgage or rent payment. Followed up by a standard set of non-discretionary items: gas, electric, cell phone, internet, insurance, car, student loans, etc.

Discretionary Expenses

Then you have discretionary buckets: groceries, gas, eating out, beers and clothing. This is where a budget is key in getting a handle of your discretionary expenses. Watch out little expenses add up fast…ahem, eating out.

Your goals

After you deal with your general monthly expenditures, you are left with the excess to allocate to your savings for goals like: buying a house, buying a new car, going on a vacation, saving for kids to go to school and retiring. Typically, the savings buckets are filled with little drips from spigots, if there is any excess at all. Sometimes, your top bucket is empty at the end of the month, and you end up needing a credit card to fill some of your expense buckets.

Next: How to get Started

it’s easier than you think

5 Ways to Save on Your Next Ski Vacation

5 creative ways to save money on a ski vacation.

Each year I look forward to my annual, guys’s snowboarding trip in Colorado. It is a nice way to reconnect with my friends, enjoy nature and a fun way to burn calories. It also provides me the time to catch up on reading, research and recharge. Heading out West each year for a snowboarding trip, may seem a bit extravagant but there are several things I do each year, to save on my trip expenses.

6 Creative Ways to Save on a Ski Vacation + 1 Budgeting Trick

I buy a ski pass in June, at the lowest rate for around $400. If you spend the money up front, the pass ends up paying for itself after the 3rd day on the slopes.

I have purchased high quality ski gear, and I don’t upgrade it often. My Obermeyer pants and jacket shell are vintage 1999 … they are also a unique color so I am easy to find on the mountain, which is key when riding with a group. My Polarmax base layer was purchased circa 2002. Polarmax is based in the states, manufactures locally and focuses on making the best base layer possible. My Burton mittens were purchased in 2010, and keep me super warm. My Burton boots were purchased end of the season, on sale, of 2016. And my latest purchase was a helmet, that keeps me safe and incredibly warm, in 2017. Anything that does not perform up to spec, gets dropped and replaced by the best possible alternative.

I shop around for airfare well in advance. Both Delta and Southwest fly to Denver. I keep an eye out for prices starting 2 or 3 months out. When I see a significant dip in prices, I jump on it and make the purchase.

I rented a car from Enterprise, that was 10 miles removed from the airport. Rentals at DIA were DOUBLE the daily rate. For an inexpensive Uber fare, I was able to save half off the total bill. And the pick up place was on the way to the mountain, so it did not cost us extra time.

I love to cook, so I always make sure I cook one or two dinners for the big crew. We typically spend ~$40/person when eating out. So eating in, twice, will save a good bit of money. The big deal about these dinners, though, is that they better be tasty, because I am dealing with some discerning dudes.

I typically budget $800 for the trip. In order to pay for it, I prepay my Amex $200 each of the 4 months prior to the trip. Then, when I arrive, I just spend up to a 0 balance!! It keeps me from getting home and having to write a huge check at the end of the month.

Last night I made White Chicken Chili, the guys loved it, not just because it was free but it was delicious too.

Josh’s White Chicken Chili

Perfect for APRÈS SKI

Saute 5 chicken breasts followed by 3 thighs over high heat in a large dutch oven

Add a glug of olive oil, and then a diced onion and drop the temp to medium heat

After the onions are well browned, add 6 minced garlic cloves, a minced poblano pepper and half a minced jalapeno

When the garlic is fragrant in the pot, deglaze with half a beer, preferably Coors, when in Colorado

Add a can of diced tomatoes, a can of chipotle peppers in adobo, .a can of salsa verde, 4 cans of cannellini beans and plenty of chicken stock to cover everything. Raise to a boil.

Add a table spoon of chili powder to it all, and then cut up all of the chicken and add to pot

After the chili comes to a boil, lower the temp, until you have a nice soft rolling boil

Cook for 45-60 minutes

Stir in 2 or 3 table spoons of sour cream

Serve with fresh cilantro, shredded cheese (or cottage cheese) and sour cream

Best accompanied by cheap American lager

Want to discuss how you can plan ahead and save on your next vacation? Short term goals are important and help keep us on track with saving for our big, long term goals. Contact me, helping people make smart financial decisions, have fun and save for their fortune is my passion.