14 Questions to Ask a Financial Advisor Before Investing

It’s not easy finding a financial advisor. He or she needs to be someone you can trust with your hard earned money and you need to feel comfortable speaking candidly with them about your concerns, wants and needs. Asking these questions can help you decide out if this person is a good match for you and your family.

A Financial Advisor needs to be someone you can trust, you need speak candidly with them about your concerns, wants and needs. Asking these questions can help you decide if this person is a good match for you and your family.

Are you a fiduciary?

Yes. I am a fiduciary. From an SEC perspective, that means I list in my ADV form 2 how I get paid, the services I offer, and any conflicts of interest. Being a fiduciary means more than that to me: I put my clients interests ahead of my own. I work with trusted 3rd parties. I look for the best products for clients, taking into account quality, cost and timing. I don’t take any commission of any sort.

2. How do you get paid?

There are three ways I get paid:

Providing financial services on an ongoing basis. Monthly subscription of $125/month.

Creating a financial plan ($125/hour approximately 8-12 hrs).

1% of assets under management

For details on these offerings see Services.

3. What IS YOUR “all in” cost?

In addition to the services I outlined above, you would pay:

If I am managing your accounts, you would pay $15.95 per trade through my custodian, SSG.

Standard capital gains/losses on trades

.04%/year on ETFs (that comes to 40c per $1000/year)

4. What sort of tools do you use for budgeting?

I have a spreadsheet that utilizes a range of custom formulas that makes itemizing expenses, income and savings simple and easy to understand . Additionally, I have a variety of software and tools that facilitate the financial planning process.

5. How Do you deal with security?

My clients security is my top priority and is integral to my business. All of our assets are protected by multiple sets of encryption. Online access to accounts are protected. I use 2- factor authentication when sharing cleint information. Any spreadsheet/worksheet that I use is protected with unique and secure passwords.

6. What are your qualifications?

I work with families in a range life stages. I earned an undergraduate degree in Industrial Engineering from GA Tech and an MBA from Ga State. I passed the series 65 exam.

7. How would our relationship work?

I believe the key to a mutually beneficial long-term relationship is through trust and context. With that context I can better provide useful advice. I believe that meeting 1 time per year is not nearly enough. Our meeting cadence will be determined by my client’s situation as well as the issues needing addressed. My clients call, email and text me as needed and I respond in a timely manner.

8. What is your investment philosophy?

The best long-term results are achieved through creating an asset allocation that is well diversified, that will meet your goals (given your risk profile) and requires continual contributions.

I am not a stock picker. My solutions are data-driven. Historical data shows that the vast majority of stock pickers are not capable of beating their respective indexes, and generally end up with higher administrative fees.

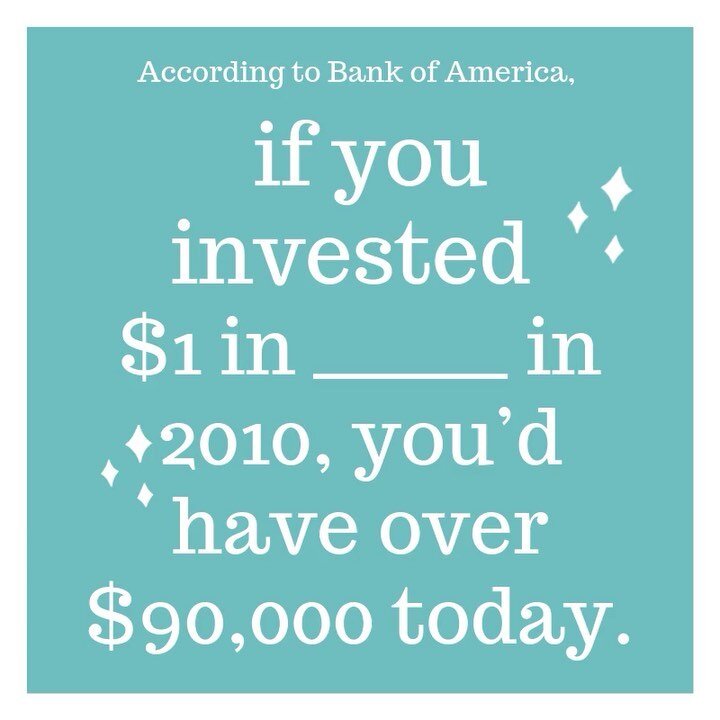

I use low cost Exchange Traded Funds (ETFs). I believe the future will look better than the past, and as such, the best companies in the world, as represented by ETFs, will continue to appreciate over the long-term. I do not worry about the daily variations of the market, which tends to be irrational in the short term.

9. What benchmarks do you use?

The S&P 500 and inflation.

10. Who is your custodian?

A custodian is a company that performs trades and holds your shares. Eg: eTrade, Schwab, Fidelity. The custodian I use is Shareholders Service Group (SSG). They use Pershing a subsidiary of The Bank of New York Mellon, the largest custodian in the world with over $27 trillion in assets under custody.

11. What asset allocation will you use?

The majority of a client’s allocation should be in stocks rather than bonds and cash. Historical data shows that bonds barely keep up with inflation. The key to your future is in purchasing power, which means your money needs to beat inflation.

12. Give me an example of a portfolio you’ve designed AND ANY THOUGHTS ON HOUSING.

Each portfolio I design is specific to the client and their current financial situation, goals and risk attitude. As an example, one family I work with wants to reach their financial goals early. They contribute regularly and are mentally unaffected by the short-term variability of the market. At a high level their portfolio consists of low cost ETFs in an S&P 500 tracker: 30%, Emerging Markets: 30%, Small Caps: 30%, Cash: 10%.

Any thoughts on selling the family home now, and either renting or buying a less pricey house: this comes down to the goals of the family. While its true that many family’s biggest monthly expense, largest asset and largest liability is their home, it’s also true that it is their highest utilized asset. If you live in a house, that fits the size of your family, has attributes that you appreciate and does not cause you undue financial hardship … why mess up a good thing? If that set of “if’s” you cannot answer in the affirmative, and you can find a house that better meets your family goals … well it may make sense to move. As in stocks, I am not a believer in trying to time the housing market. I have heard rumors of friends in Decatur who are considering selling now (at a perceived high), renting for 2 years until a drop, and then buying again. I think thats crazy talk, for at least a dozen reasons.

13. What are the tax implications of working with you?

If I am managing your assets, any transaction sales will have some sort of tax implication, through capital gains/losses. I limit the tax implications by limiting the # of transactions.

14. WHY FAMILIES? WHY PROFESSIONALS?

In my experience the complexities of families deserve an added set of professional eyes administering a solid plan. There are many moving parts to a family, that include the expenses of starting a family, all the way into paying for college and eventually estate planning. More voices from a family generally brings more perspectives, something a trained professional can aid in clarifying.

Professionals are people driven to be really good at job, hopefully a job they love. In order to drive to be the best, many professionals are forced to neglect certain aspects of their lives. I have seen too many extremely smart professionals who have neglected their finances to the detriment of the long-term success of their family. I believe that by relieving families of this variable, we are all working for the greater good.

THE NEXT STEP

If you’re ready to take the next step toward financial independence, I’m here to help. Working together we will develop a personalized financial plan based on your unique needs. Set up an initial consultation.

Follow Us On Instagram: Chamberlain Financial

The Financial Mistake You Don't Realize You Are Making?

I was talking with a family friend, who’s retired, about how she was managing her affairs. She felt confident that all was well. She and her husband had recently updated their will. I nodded with approval,

I was talking with a family friend, who’s retired, about how she was managing her affairs. She felt confident that all was well. She and her husband had recently updated their will. I nodded with approval, as its always a wise move to have your will reevaluated every so often. I’m curious (nosy) and try to be helpful, so I asked her more questions. After I asked about her stock/bond/cash allocations, we moved on to insurance. I asked about long term care, in case circumstances changed and they needed assisted living. She got real quiet and then all of a sudden blew up in frustration …

“I didn’t think to ask about that but WHY DIDN’T THE LAWYER??!! I’m calling him tomorrow!”

It’s a common revelation to people I meet with: On your own, you’ve engaged with several specialists but don’t have a financial advisor with a holistic view of your entire financial health to make sure everything is covered. Similar to a primary care physician who sees you on a regular basis and advises when to see a trusted specialist. Or a systems architect in software, who understands how the myriad components of a system interact.

You may have someone for stocks and bonds, a medicare guru, an estate lawyer, a real estate lawyer and an insurance agent … but do you have anybody that has the overall holistic view of your plan, tying everything together? Someone who’s family’s future, is directly tied to your family’s future success?

At Chamberlain Financial Advisors, we assess all aspects of your situation, providing solid advice throughout. We are fee-only, meaning we don’t get commissions to sell you products. Where we need experts, I facilitate the conversation. The ultimate goal is your overall financial health.

Do you have an advocate with a holistic view of your family’s financial situation? Are you DIY’ing it, but don’t really understand all aspects of the plan? Set up some time with Josh. Let’s get fully healthy.

Why Would You Pay More For Xfit Each Month Than a Financial Advisor?

To stay healthy we pay ~$150/month for Crossfit or Yoga. Now you can have your own personal advisor working with you to ensure you meet your financial health goals, for less than your monthly health studio membership.

A recurring theme keeps coming up in conversations with potential clients... the idea that they "don't have enough dough" to "deserve" a financial advisor because they don't have significant investable assets lying around.

This notion, incidentally, is perpetuated by many advisors that won't talk to anyone with assets under $500,000! Because apparently their time/overhead is worth more than $5,000/client/year?

I became a financial advisor because of my love of investing and finance and my passion for helping others reach a place where cash is not the primary variable in determining a family’s long term decisions. It is important to me that my services are affordable and accessible so that I can build trustworthy and lasting relationships with as many people who could benefit from my help. To do all these things I have put together a win-win solution for those who don't have a boatload of assets -- yet.

Introducing Chamberlain Financial Advisors' Monthly Subscription

I want to work with people in their 30's and 40's that have great potential, realize they want to meet long term goals, and need someone they trust to help shepherd them through. I am offering a monthly subscription option, that is less than your monthly Crossfit or Yoga membership -- and it's equally as important for your (financial) health!

We will develop a regular cadence for meetings, virtual or in person, around your schedule. We will work on budgeting, investing, insurance (I’ve got a guy you can work with), saving for a house/boat/college expenses, annual company elections and anything else you may have on your mind. And as we work together, we will build a lasting relationship of trust.

Financial Planning & Investment Retainer

$125/month + $997 Upfront Fee

For those saving for retirement and who want to stay ahead of the game. Chamberlain Financial Advisors will create and manage your plan, guide your through the implementation process, monitor your investments and advise you as life changes.

Full implementation

Ongoing guidance

Investment advice

No asset requirement

Virtual planning available

Can you afford to put off this decision any longer? Do right by you and your family and start investing in your future. Schedule a call to discuss how, for less than your monthly cable bill, we can start building your wealth and reach financial freedom.

(**And Jenn and I love our fitness routines!! We love y’all @crossfitdecatur and @purebarredecatur.)