How to Save $750 in Open Enrollment

Open enrollment is the time to maximize your coverage and 401k choices while minimizing your spend. Learn how to make the most of this opportunity.

It’s time. You’ve received your company’s annual mailers and email reminders, announcing that open enrollment is coming up. BE READY!! Let the fun begin! And how about those 25 page, thick paper, glossy photo brochures for your options? Everyone always looks so happy.

Calling all CDC, Cisco, Coke, Delta, Eaton, Georgia Pacific, Home Depot, Mailchimp, Siemens, State Farm and other GA professionals and families!! LISTEN UP.

The Goal

The goal of open enrollment is to update and optimize your elections, given any potential changes in your situation. What kind of changes?

Someone in the family is going to need braces or extra dental care?

You are planning to have a baby

Your significant other changed jobs

You got a raise and need to increase how much you put into your 401k

You are afraid that Trumps’s tariffs are going to bomb the market, and you need to reallocate your 401k

You never really thought about needing disability insurance, until now

Your kids are starting day care or aftercare and you heard you could invest pretax cash in a dependent care FSA

There are any number of things that could need to be updated. But most people mistakenly think this is just a boring chore, with little added value. And anyway, you made the elections last year, why spend the mental space on it again?

Or worse than complete ambivalence about the topic, you know you need to make some changes, but you are “too busy” to read the literature, preventing you from making a wise decision.

It is easy to end up spending an extra $750/year, with poor choices.

Focus on your vocation and vacation!

Schedule time with me to run through the options. THIS IS A GREAT OPPORTUNITY TO GET AN EASY WIN. I can point out how to maximize your coverage and 401k choices while minimizing your spend … all while focusing on your long term goals. We can get started looking over your options, over a cup of coffee, and it won’t cost you anything.

I’m looking forward to catching up with you.

**After publishing this blog, an interesting article was published from Kaiser Family Foundation data, showing that employee based healthcare costs around $20,000/year ($14k = employer, $5500 = employee)

Follow Us On Instagram: ChamberlainFinancial

Take the "Smart Couples Finish Rich" Financial Knowledge Quiz

Take this financial quiz to see how you and your partner are doing with your finances.

When it comes to finances, David Bach and I have a similar outlook which includes that there is generally one CFO in a couple. However, just because there is a single CFO, both partners still need to understand and agree on the overall family finances. In our family, I’m the CFO, but together Jenn and I have established our goals and she knows how to access all of our investment and insurance accounts, if needed.

Given that it is very likely that you have one CFO, it is extremely important to understand what you both should “know” and what should “be able to get your hands on give an hour or so”. Take this quiz with your partner and check for your scores at the bottom. Reproduced from David Bach’s New York Times Best Seller, Smart Couples Finish Rich.

True | False I know our current net worth (i.e. the values of the assets we have minus the liabilities we owe.)

True | False I have a solid grasp of what our fixed monthly overhead is, including property taxes and all forms of insurance.

True | False I know how my partner feels about our monthly overhead. We have discussed both the size and nature of our regular expenses and obligations, and are comfortable with them.

True | False I know how much life insurance my partner and I carry. I know exactly what the death benefits are, how much cash value there is in our policies (if any), and what rate the money is earning (if applicable).

True | False I have reviewed our life insurance polices sometime in the last 12 to 24 months, and I am comfortable that we are paying a competitive rate in today’s insurance market.

True | False I know the current value of our home, the size of our mortgage, the interest rate on the mortgage, and how much equity we have in our home. I also know the length of our mortgage-payment schedule and how much it would cost per month to pay down the mortgage in half the time.

True | False I know what type of homeowner’s or renter’s insurance we have and what the deductibles are. I know whether or not our policy would provide us with ‘today’s replacement cost’ or actual cash value, if our home and/or property were destroyed or stolen.

True | False I know the nature and size of all our investments (including cash, checking accounts, savings accounts, money-market accounts, CD’s, treasury bills, savings bonds, mutual funds, annuities, stocks and bonds, real estate investments, and collectibles such as stamps, coins, artwork, etc) I also know where all the relevant paperwork is kept.

True | False I know the annualized returns of all the above-mentioned investments.

True | False I know the current value of all our retirement accounts (including 401(k) plans, 403(b) plans, IRA’s, Roth IRA’s, SEP-IRA’s, Keogh plans, company pension plans, etc.) I know where the statements for these accounts are kept and I have a solid grasp of how all our accounts performed last year.

True | False I know what percentage of our income we are savings as a couple.

True | False I know how much each of us is putting into our respective retirement accounts, whether that amounts to the maximum allowable contributions, and what our respective vesting schedules are.

True | False I know how much money each of us will be getting from Social Security when we retire, and what our pension benefits (if any) will be.

True | False I know whether or not we have a will or living trust, what its provisions are, and how up-to-date it is.

True | False I know whether our income would be protected by disability insurance should I or my partner become unable to work. If we do have disability insurance, I know the amount of coverage, when the benefits would start, and whether they would be taxable. If we don’t have disability insurance, I know why we don’t have it.

True | False I know what my partner’s wishes are regarding medical treatment (including being kept alive by artificial means) in the event he or she falls seriously ill or is seriously injured. I know whether or not our will includes a valid power of attorney covering such situations. I also know how my partner feels about being an organ donor.

True | False I know if my partner has taken an investment class in recent years.

True | False I know how my partner’s parents handled their finances and I know what effect that has had on how my partner feels about how we manage our money.

Scoring

Give yourself 1 point for every time you answered “True,” and 0 for every time you answered “False.”

14-18 points. Excellent! If you are the CFO, well you are doing your job!! Kudos. If you are the “not so much CFO”, you and your partner obviously have been planning together, as a result of which you have a good grasp of the state of your finances and how you both feel about money.

9-13 points. If you are the CFO, you have some work to do, you have some gaps in your responsibility. If you are the “not so much CFO”, you need to at least be aware of how you can answer these questions, in about an hour. Preferably by something provided by the CFO on some regular cadence.

Under 9 points. You and your partner don’t make a habit of talking about money, do you? As a result, your chances of being hurt financially because of insufficient knowledge are enormous . You need to learn how to work together in order to protect yourselves from future financial disaster.

If you have some gaps, contact me. This is all covered by our planning process.

Equifax is Paying for their Data Breach, Collect Your $125.

As part of the settlement, it was agreed that Equifax would repay everyone effected $125 for the breach. Here’s how to collect your money.

After a terrible data breach, Equifax has been fined $575MM by the Federal Trade Commission. The breach affected 148 million Americans, who had their SSN and addresses stolen. It was a situation that was easily preventable, had Equifax been taking some moderate precautions (or listened to the advice they were given months before the breach). And it led to the departure of several of the companies execs, including Richard Smith, the CEO.

As part of the settlement, it was agreed that Equifax would repay you $125 for the breach. Or you can select to get 4 years of protection against future problems, with credit reporting. In all likelihood, you have this protection built into your current banking. So take the money and run.

Its super simple, and takes less than 1 minute to complete the process:

https://www.equifaxbreachsettlement.com/

So go collect your cash. And spread the word!! The more people who collect, the more expensive it is for the company, and the less likely this is to happen in the future.

The Financial Pitfall of Making Six Figures

My partner and I make 6 figures, where the hell does it all go?!

My Partner And I Make 6 Figures, Where the Hell Does It All Go?!

There’s a common refrain I’ve come across with many of the families I meet with in Decatur and surrounding neighborhoods: We make a good living, our family is thriving, but we don’t have any money at the end of the month? After I review their spending accounts, I see big pay checks coming in. I see nice sized chunks of cash going out for nice cars and houses. And then 75-ish seemingly “insignificant charges” of between $50 and $250 throughout the month. This is the beginnings of an archetype, I am starting to call “We make enough money, that we don’t have to worry about our spending”.

You may fit into this category if:

Your family income is greater than $175k/year

You have 2 to 3 kids that have expensive extracurriculars and/or tutoring

You go on a week long vacations 4 to 5 times/year

You may have a stay at home partner

When you see something interesting, you just buy it

You emphasize convenience over cost

You contribute money to your kid’s school and class all year long

You don’t really check your bank/credit card statements

You are well respected in your professional career

This is an interesting group, and something that seems to happen much, around Decatur and other in town neighborhoods. The amount of income you make, lulls you into thinking you don’t need to be intentional with your finances. That is, until something happens that causes you to reevaluate your situation: A friend gets laid off, you decide you hate your job and want to make less money and contribute more, a major housing renovation or project, a friends kid heads off to college, you want a pool in your backyard, etc.

Which inevitably leads to a quick analysis of the family’s current situation, and you realize:

“Dang!! Where does it all go?” or “I am too busy to deal with this, I am going to punt for some time in the future when I have more time”.

If you are in this situation, with just a little bit of work, you can make a big difference in your family’s long term outcomes. Let me help you:

Consolidate your credit cards

Set up automated bill pay

Set up automated investments

Pre-plan and budget for your family vacations

Check out your car/home owners insurance for the best price and coverage

Prioritize and fix the things in the house that need to be addressed

Get the kids set up for college savings

Land a new job that matters to you

Sell your RSU’s

Minimize your tax bill

A good financial planner does so much more for your family, than just manage your investments. They are an advocate and partner, working in lock step, to make sure that you are living your best life, NOW and IN THE FUTURE. **But you can’t afford to wait. Guess what? You will never have “enough time” to get this work done. It is all about prioritizing the work, and getting started.

Let’s set up some time to get your family moving intentionally towards your goals.

Financial Planning for Young Professionals

Millennials have a huge advantage when it comes to investing but they have to take advantage of it now:

Not long ago, a young couple set up a meeting with me to discuss some of their finances. I called to learn more about what problem they were trying to solve, and learned that they wanted to make sure that their investment portfolio was appropriately diversified. As we were setting up time for the meeting, I asked how they were doing with debt, credit cards and if they had extra spending money at the end of the month. There was a pause. Then she said “You work with clients on that sort of thing?”

“Of course I do. In fact, it’s what I spend a lot of my initial client time working through.”

In our first meeting we spent ten minutes reviewing their stock allocation, and then the next 70 minutes working on an approach to better manage their monthly spending and consolidating their credit cards.

I have a fundamental belief that everyone needs a financial advisor. Millennials have a huge advantage over their elders when it comes to investing, but they have to take advantage of it now:

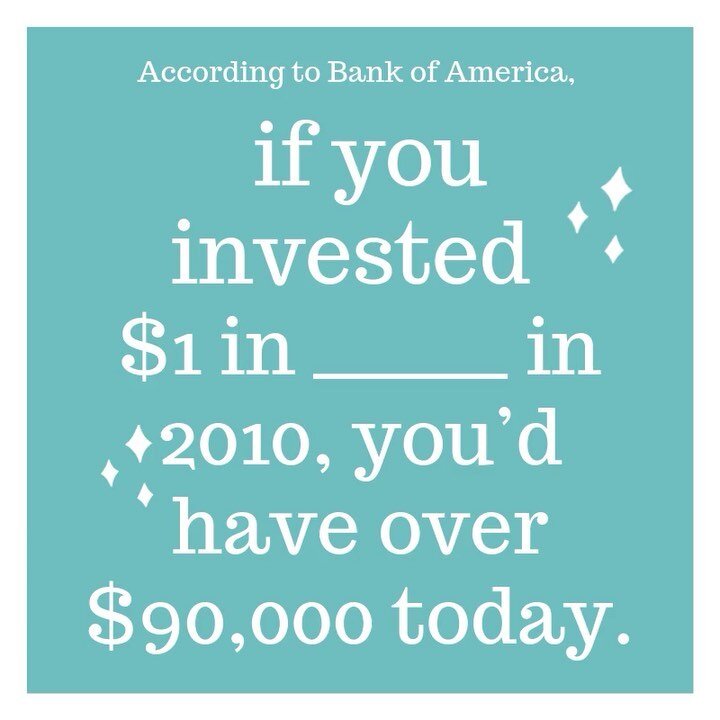

Time is on your side - Money grows over time and it makes a profound difference over a long period of time. As an example, if you invest $2k from 19 years old to 26 (8 years) when you retire, you will have $1MM. If you wait until you are 27 to start saving, you would have to put away $2k each year until you are 65 (39 years), and still only have $900k. So start early!

Setting up good habits - It is always easier to start with a strong and thoughtful foundation, rather than reseting in the future, due to bad behavior. Lets set up good habits now so that you will benefit in the long term.

Whether it is helping to budget/monthly spending, set goals, mediate differences between partners, set up investments, talk taxes or buying a car, a financial planner can be a steady hand to help.

If you are a young professional, you may think a financial advisor doesn’t make sense for you because you likely

Don’t have much of an investment nest egg

Don’t own a house, and are very likely renting

Live paycheck to paycheck

Have debt due to student loans and/or credit cards

Don’t have kids and thus have fewer variables in your life equation

Have long time before retirement

You use an online tools/service for budgeting or saving

If some subset of that list resonates with you, here are some things to be thinking about:

Am I successfully balancing my short/mid/long term goals?

Am I saving enough?

Am I spending too much?

Do I love what I do at my job?

Do I have disability, term life and health insurance?

Am I accessing all of the amazing array of benefits my company offers (ESPP, anyone?)

Does my partner see eye to eye with me on spending and saving?

Is there harmony between my spending and my values and goals?

Should I be consolidating your debt?

Too often it seems that young professionals make their decisions in isolation, without seeking advice from someone with more experience. Perhaps there is information around the internet that could be gleaned from a quick google search. A financial advisor, who gets to know your background and experiences, can provide much of the needed support to help get your financial house in order for the long run. Helping you set up much of the foundation, so that you can answer the questions above, with certainty and confidence.

You don’t need a small fortune to start this process and to get competent help, Chamberlain Financial Advisors is here to help! I spend the time getting to know you. I understand your context, so that the advice I give you, meets your specific needs. Lets create a plan that will help you build to that fortune, so that your future self is delighted to meet you. And don’t worry, I get that you are busy, I work to make your life easy. We can meet for lunch, after work for a drink, or I can come by your house for consultations.

The Difference between RSU's and Stock Options

RSUs and stock programs are different, and should be treated differently.

If you work in today’s big technology industry, it is very likely that you are getting some form of stock based incentive, as part of your compensation. The two most common forms of compensation are restricted stock units (RSUs) and stock options. These two programs both offer very nice incentives for employees, but they are slightly different, and should potentially be treated differently. Also, any time that you hold some form of company stock, you should view your exposure to the company from a holistic perspective, to your overall portfolio.

What is an RSU?

RSUs, are awarded to employees at some date, and typically have a vesting period at some point in the future. Often the vesting will be 25% at the current date, and 25% in one year, 25% in 2 years … etc. At the time of vesting, the company buys a share, and gives it to you. In this way, it is much like a cash bonus. And like cash bonuses, the company will withhold taxes at that time of vesting (commonly, they will just keep shares from your award).

For example, you just received 100 RSU’s that have vested. The company stock is $1. You will received 100 shares of your company at $1 = $100 of compensation. Assuming you are in a 25% tax bracket, the company will hold 25 of your shares. Which means you net out 75 shares.

What do you do with an RSU?

You have 2 options with RSU’s … you can either sell them immediately or hold them. If you sell them immediately, since you just paid the taxes on them, and they likely have not appreciated much, you will not have to pay any capital gains taxes, and you will just receive the cash. if you decide to hold them, and they appreciate, then you will have to pay the capital gains on them.

One major advantage of RSUs

They almost always have value, even if the price of the stock has dropped. For the certainty of that value, RSU are commonly deemed more valuable than stock options. Which brings us to …

What is a stock option?

A stock option, gives the holder the right to purchase a stock in the future at a predetermined price. Like RSUs, options are given out as performance incentives, and typically have a vesting period.

For example, you have the option to purchase your company stock in 1 year’s time at $1. If the stock goes up $1.50, then it would make sense for you to purchase the option at $1, because you would have a built in .50 return. If the stock dropped to $.90, you would not exercise the option, b/c you would be better off to buy it on the market for $.90 than through your options at $1.

**Note that exercising the option is a purchase, but not a sale. Which means that you will not pay any taxes at the point of the exercise. You will only pay taxes upon your sale of the stock.

What do you do with an option?

You should have no more than 5% of your portfolio in single stock.

You can either sell it immediately and pay the capital gains equal to difference b/w the current price and the price at exercise. Or you can hold it. There are advantages to holding it for greater than a year, since you will pay the long term capital gains tax (as opposed to short term capital gains, assessed at your ordinary tax rate).

Advantages of options

You have greater control over taxes with options, since you decide when to sell them (and thus when to pay taxes on them). And since they are riskier, companies typically give you more options.

How do options and RSUs play into your overall portfolio?

Most people just let both their RSU’s and options sit and collect over time. They don’t manage them, they don’t sell them, they don’t really think about them until they move to another company, or they grow big enough to force a conversation. This is a BIG problem. From a simple portfolio diversification perspective, you should have no more than 5% in single stock. And your vested options/RSUs are part of your portfolio. If you have 100k sitting in RSU’s or options from your company, you are very likely way over-allocated. Second, you already have plenty of exposure to the results of the company. Just check your bank account every other week, who is making auto deposits?

If you have “new” RSUs just sell them, you won’t (likely) have to deal with any major tax consequences. If you have older RSUs then you will need to check for capital gains exposure, and make sure you factor that into your savings for next year. Since you had to exercise your options, that means, that very likely you have some major capital gains exposure. So beware, when you sell them.

After selling them, increment into a low cost ETF, rinse and repeat next year.

How and When to Invest in an IPO

There are plenty of IPO investing opportunities on the horizon, use my strategy to avoid the pitfalls.

2019 is primed to be a very compelling year for initial public offerings (IPOs) for interesting companies. We are about to have a whole cast of new unicorns entering the prime grazing ground of the US markets. There are plenty of opportunities to get involved, as well as pitfalls you should be aware of. You have likely heard of recent newcomers including:

Lyft (LYFT), the new age transportation (taxi?) company

Pinterest (PINS), a next generation sales and marketing platform

ZOOM (ZM), a new comer to video conferencing world, with a killer application

BEYONDMEAT (BYND), pushing the boundaries, providing a better way to feed the planet

As well as a few big ones, yet to come:

In complete transparency

I own a number of stocks discussed in this article: LYFT, PINS, AMZN, and FB.

Uber, the ride hailing company, looking to push into autonomous driving, food delivery, smart cities and more.

Slack, the future of business communication: beyond email

Here is the thing, about IPOs:

IPOs are RISKY!

If you buy on the opening day, you only “think” you are getting in early. Most of the “early” shares are allocated to big players.

You may think that you understand the business model, and the goals of the company. But often the long term strategy has not been fully vetted (think Amazon coming out as an online book store, Google as a hopped up search engine and Facebook as a way for college students to connect). Or the long term strategy has not been fully broadcast and understood.

The real numbers behind the business, while private, have not been fully vetted by the market at large.

There are just as many examples of short term flame outs, after IPOs, as there are successes. Recent examples include:

lyft - down from high $80’s to low $60’s in the first month;

Spotify - launched in May 2018 at around $160 and is now at $136;

Remember Facebook’s bumpy first year? It launched in May 2012 at $38 and closed one year later $27.50.

But there are wonderful opportunities in buying stocks of companies at an early point and then holding them for the long term.

Nobody, still holding FB, from the beginning, is fretting about the first year decline, given the current price of $195. Nor are people worried about Amazon starting at $18, now worth $1,900.

The best long term strategy for building wealth is

to invest in a few widely diversified, low cost ETFs.

So how do you approach this delicate situation?

First Know this: The best long term strategy for building wealth, is to invest in a few widely diversified, low cost ETFs. Then continue to buy through the short term, ups and downs of the market.

If your risk tolerance is low, stay away.

Wait until things shake out over the course of the first year or so. This will give analysts the opportunity to dig through the numbers, the business strategy and company leadership. These stocks will also end up in your broad based ETFs. So don’t worry, you will gain exposure.

If your risk tolerance is high,

meaning you can deal with wild swings, you can afford to risk a total collapse in the company and you have some money not currently allocated to your long term goals. I believe there is a way to tip toe into the situation.

How to determine if you should invest in an IPO

You need to have a strong conviction in the company’s business strategy. For example, you believe that meat production, on a world wide scale, is going to lead to a long term detrimental impact to the Earth. And you believe over time, that people will become more open to alternative sources of protein, then BYND may tick this box for you.

You need to have a long time horizon, for the market to completely factor in all of the unknown variables into your company. In the short term, these stocks are going to trade wildly. And are actually a perfect example of how irrational the market is SHORT TERM. For example, it is inexplicable why lyft traded between $58 and $62 last week … there has been NO real new data, at all.

You need to determine how much of your portfolio you are willing to BET on this strategy. You should be thinking < 1%.

You need to have an entry and exit strategy for buying/selling the stock.

How I Invest in IPOs

I buy 1/3 of my allocation, based on #3 above, at the end of the first trading day. NOT at the beginning. The bid/ask will be too wide early, with all of the jockeying. By the end of the day, the day traders looking to cash in on the first day volatility, will be ready to sell. So around 3:30pm, put in a buy order.

Sit tight for, either some set time frame (2 - 5 months), or until there is a major slide in the stock. Many times, reality will set in, people will come to understand that they need to gather some additional information on the company. At that point, the stock will take a breather and potentially drop 10-25%. If that happens, buy 1/3. If the stock goes up or trades side ways, just plan to buy at a set future date.

Set a third time frame, well into the future, like 1 or 2 years. This will have allowed all of the institutional/inside money to exit after the lock up period has expired. And there will have been several quarters of legit reports, that can be used to determine just how serious the company is. Buy your final 1/3 at that date.

Buy and hold. If you believe that the company has a good strategy, and is in a growing market, and has good leadership, your holding period should be indefinite.

When to Sell

Each year, when evaluating your asset allocations, it is a good time to consider how this investment is playing out. Sell if the stock has appreciated and is now a much higher percentage of your overall portfolio, than makes sense.

Sell if the company has taken a strategic direction that is different than your original understanding.

Sell if the company leadership proves unable to keep up with the challenge.

Sell at some set date into the future.

Sell if the stock reaches some percentage of gain/loss, that you are happy/unhappy to have achieved.

If you have a plan, your outcomes will be set and understood, and you will have an opportunity to take the emotion out of this investment.

*** Please, Please PLEASE, don’t check this stock on a daily or weekly basis. The more you check it out, the more likely you will be to get emotional and make a decision counter to your above strategy.

Questions? If you want to talk more, drop me a line, I am happy to provide further clarifications.